Over the years, the greater Houston region has gained a reputation for affordability. Historically, Greater Houston is the rare major metro in which the cost of living is low and overall opportunity is high, especially relative to its size as the fifth largest metropolitan area and the fourth largest city in the nation.

Our region’s affordability is one of the main reasons the Houston population (the nine-county Houston metropolitan area) grew at the fastest rate in the last decade (18.8% between 2010 and 2019) among the 20 most populous metros in the nation. That reputation for affordability may be threatened by the hot real estate market, soaring gas and energy prices, and 40-year high inflation rates, begging the question: is Houston affordable, still?

Continue reading about Houston’s population growth

Rising home and transportation costs and the widening affordability gap

Prices and sales have soared in the Greater Houston housing market, like much of the country, to a level that many experts believe is untenable. According to research from Greater Houston Partnership, the median price of a single-family home in the nine-county Houston Metropolitan Area has increased nearly 45% over the past four years and 14.5% in just the first six months of this year alone. If folks can’t purchase homes, they need to rent, but that option has offered little relief as rent prices are up nearly 20% since 2020, according to the Partnership’s analysis of Apartment Data Services data.

The median price of a single-family home has increased by nearly 45% over the past four years.

Harvard’s Joint Center for Housing Studies estimates that some four million renters nationwide were effectively priced out of buying a home due to rising interest rates from April 2021 to April 2022.

According to the 2022 State of Housing in Harris County and Houston report, the affordability gap for renters in Harris County in 2011 was $35,000. The affordability gap is the difference between what median-income households can afford and the median house price and an indication of how much housing has gone up relative to earnings. Ten years later, the affordability gap for renters has nearly quadrupled to $135,500, with 38% of that growth from 2020 to 2021 alone. According to the report, current homeowners in Harris County do not face an affordability gap — they were able to purchase a home at the median sales price with their median household income. However, homeownership may remain only a dream for would-be-first-time buyers due to increasing costs and the widening affordability gap.

There is more to housing affordability than how much mortgage or rent you pay. Typically, families would move out to the suburbs for relatively less expensive housing, but, in a region like ours where people have historically commuted into the city, that usually means their transportation costs go up.

The Location Affordability Index estimates the percentage of a household’s income spent on housing and transportation costs in a given location. According to the latest data from 2017, households in Harris County spent about 27% of their income on housing and an additional 21% on transportation, comprising nearly half of a family’s income. Comparatively, residents of Fort Bend and Montgomery counties spend more of their income on transportation than residents of Harris County.

In 2017, households in Harris County spent about 27% of their income on housing and an additional 21% on transportation.

This is due in part to the fact that we commute alone to work in our private vehicles at higher rates than other metro areas and spend more time in traffic. Despite the COVID-19 pandemic, Houstonians spent an average of 49 extra hours in traffic in 2020 — the third worst in the country. These delays cost each of us about $1,100 a year in fuel costs and lost time, according to the 2021 Urban Mobility report from Texas A&M Transportation Institute.

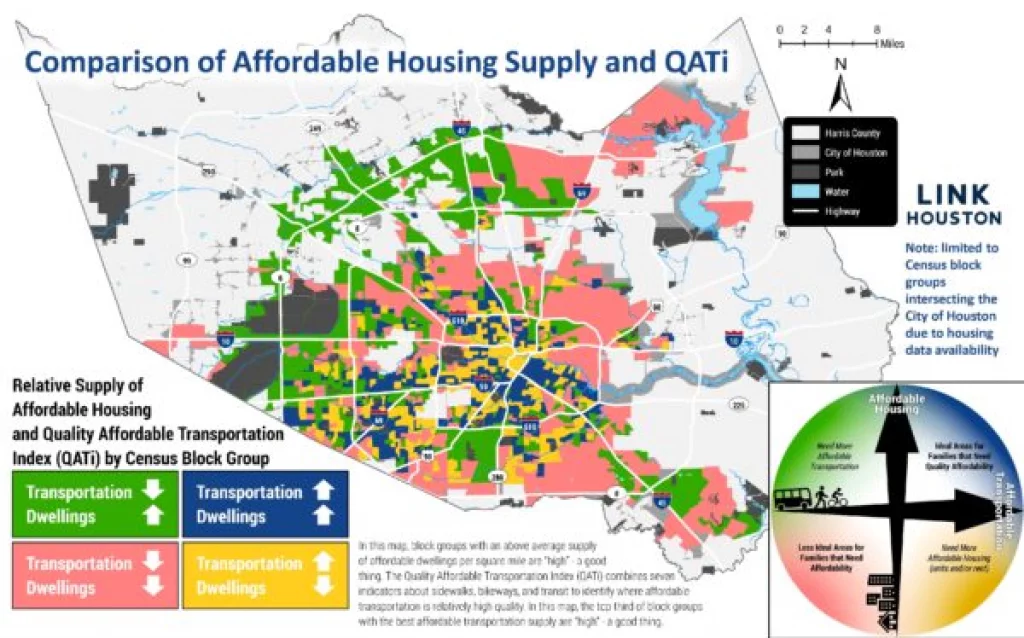

Ideally, instead of treating them as two independent issues, affordable housing and access to transportation should be aligned. LINK Houston and Rice University’s Kinder Institute for Urban Research developed the Quality Affordable Transportation Index (QATi) to map areas of quality, affordable transportation and housing. LINK Houston’s Where Affordable Housing and Transportation Meet in Houston report found that 44% of rental units in Houston are affordable to moderate-income households (defined as a family of four spending no more than $1,907 per month on housing plus utilities), and only one-third of these rental units are near high-quality, affordable transportation.

Disparities in housing affordability

Of course, the decision to buy a home depends on more than its purchase price. There are additional costs to consider like mortgage terms (including interest rates), insurance and taxes. Part of the reason homeownership remains out of reach for many marginalized communities is because of historic and current discriminatory policies and practices.

Banks deny home loans from Houston-area Hispanic and Black applicants at about four times the rate of white applicants. In 2020, banks denied home loans to 25% of Black and 23% of Hispanic applicants compared with 8% of white applicants, according to the Kinder Institute’s 2022 State of Housing report.

Further, among those who were approved for a home loan, Hispanic and Black applicants were given higher interest rates, higher loan-to-value ratios, longer loan terms and were far more likely to be heavily debt-burdened borrowers.

In 2020, banks denied Houston-area home loans to 25% of Black and 23% of Hispanic applicants compared with 8% of white applicants.

Despite declining homeownership rates and the challenges they face in the housing market, Hispanic homeowners were the only racial/ethnic group with a growing homeownership rate both in the U.S. and Houston between 2020 and 2021. Hispanic residents will soon become the largest share of homebuyers in the country.

We observe disparities in the housing market not only in loan denials or predatory mortgages for lower-value properties, but also in foreclosures. According to the Kinder Institute’s 2022 State of Housing report, foreclosures in the three-county area were disproportionately higher in suburban communities of color. Within Harris County, each of the 10 census tracts with the highest foreclosure rates consisted mostly of communities that have been historically underrepresented. The report states that these particularly high foreclosure rates are likely correlated with the unfavorable mortgage terms banks typically offer these communities.

Continue reading about housing issues such as evictions and homelessness in Houston

Energy costs in Houston are rising, but remain lower than national averages

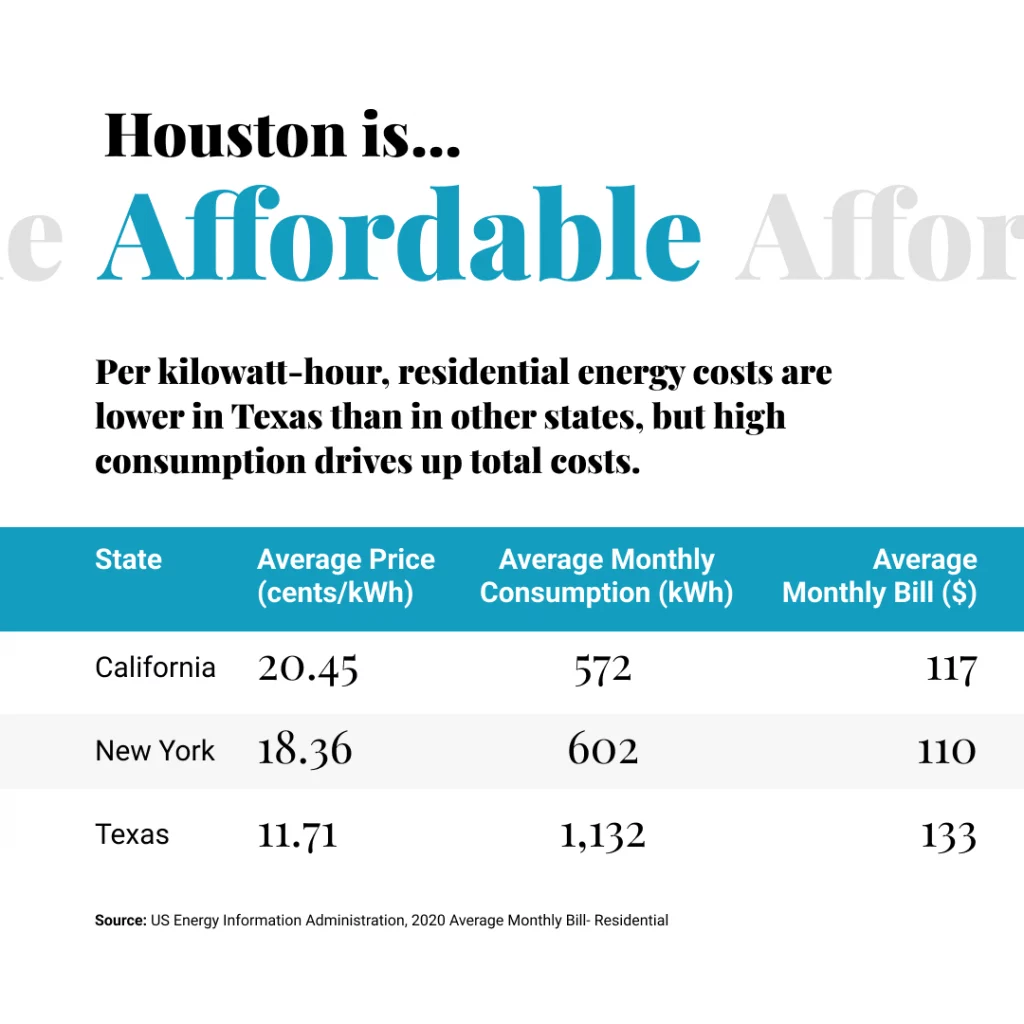

In Houston, housing costs immediately come to mind when discussing our region’s affordability; the cost of energy likely follows. While Texans pay some of the lowest rates in the country per kilowatt hour for energy, consumption drives electric bills high.

Those of us who have experienced the sweltering Houston heat, and surprisingly cold Texas winters, know that most Texans keep their climate control pumping year-round. Average monthly consumption in Texas is consistently among the highest in the country — in 2020, energy bills in Texas were the sixth-highest in the nation, despite paying less per kilowatt hour than 31 other states, according to the U.S. Energy Information Administration.

In keeping with the reasonable prices for energy in the region, gas prices in Houston are also relatively low — averaging about 7% lower than the national rate over the last decade. In 2021 the average price for retail gas in the country was $2.91 per gallon, compared to $2.66 in Texas, representing an 8% price break. Despite the recent surge in prices, gas in Texas is consistently cheaper than the national average. At its peak this year in June 2022 the average retail price for a gallon of gasoline in Texas was $4.58, 4% lower than the national average, according to the U.S. Energy Information Administration.

Inflation’s impact on the Houston economy

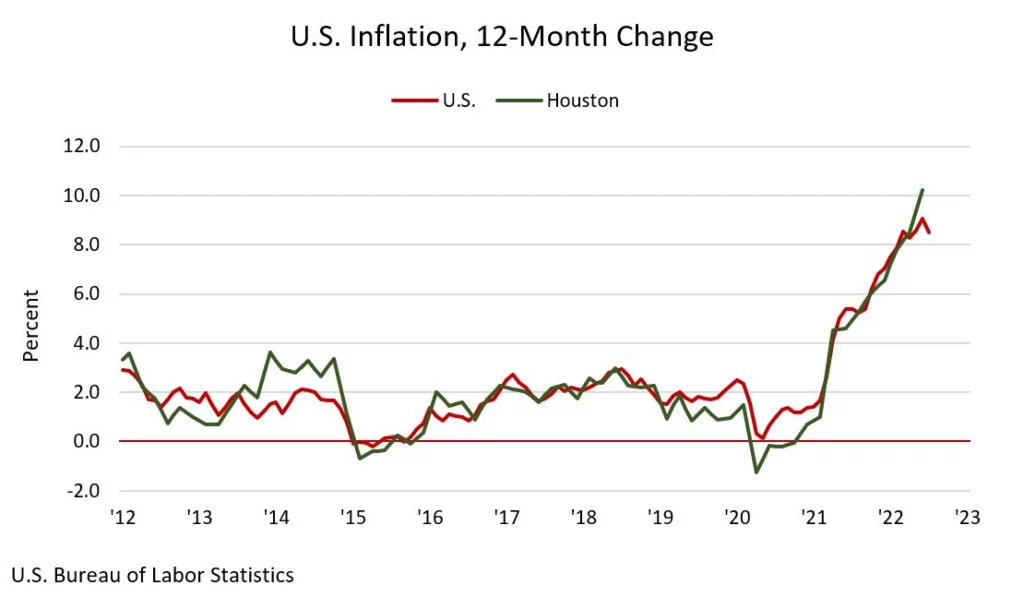

Inflation is on the mind for many in the country right now, and for good reason. Inflation rates in the U.S. and in Houston are at their highest since December 1981.

Inflation rose to 9.1% nationwide, according to the Consumer Price Index for all Urban Consumers (CPI-U), in the twelve months ending June 2022. But the inflation rate for the Houston Metropolitan Area rose even more during that time, 10.2%. Houston’s higher rate suggests stronger demand and a hotter economy compared to the nation as a whole, according to Greater Houston Partnership analysis.

Living costs in Houston are 8.3% below the national average, and 36.2% lower than the average of the 20 most populous U.S. metros.

The most recent report from the U.S. Bureau of Labor Statistics showed only moderate increases in housing costs in the region, suggesting that the true increase in Houston’s housing costs has yet to be fully reflected in the Consumer Price Index, and the real rise in inflation could be higher than what has been reported.

So, is Houston a low cost of living city? Despite inflation increasing at a slightly faster rate than the national average, the cost of living in Houston is still the second-lowest among the 20 most populous metropolitan areas in the United States, according to the Council for Community and Economic Research’s Cost of Living Index from Q1 of 2022. Living costs in Houston are 8.3% below the national average, and 36.2% lower than the average of the 20 most populous U.S. metros.

Houston’s affordability is being redefined

As the entire country becomes less affordable, so does Greater Houston. However, even as inflation continues to rise, the region’s cost of living remains relatively low when compared to other major metros and the quality of life Houstonians enjoy, including the arts and cultural amenities of a world-class city. However, historic disparities and recent events have threatened this reputation, and the region will never truly be affordable for all until our region’s prosperity provides opportunity for all.

Helpful Articles by Understanding Houston: