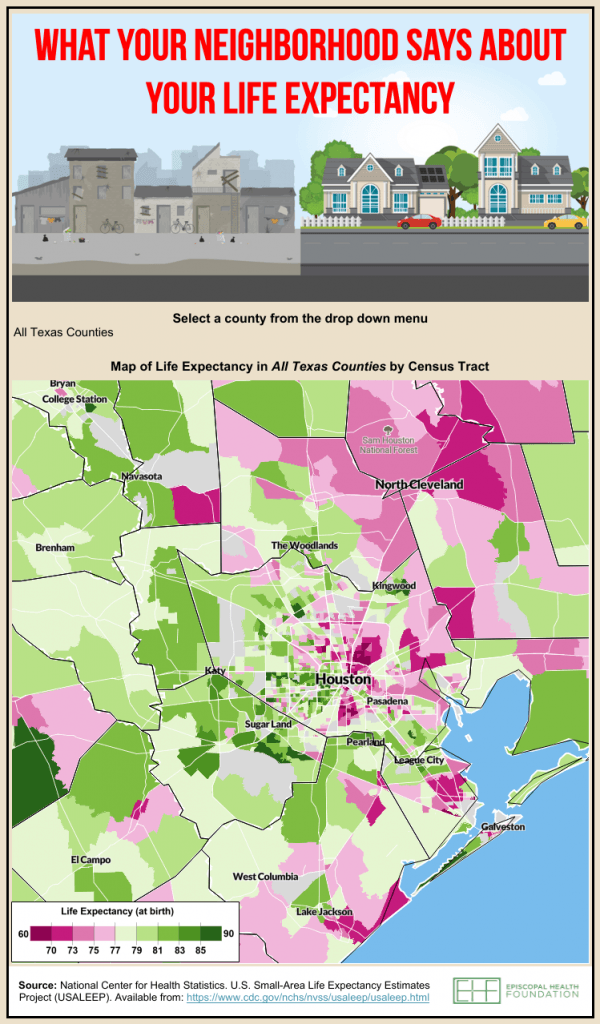

In the Houston area, there are neighborhoods fewer than 15 miles apart in which the average life expectancy differs by 21 years and future income differs by $50,000 for low-income children. The disparities may exist in the present, but their roots run deep through our region’s history.

More than 90 years of discriminatory federal, state, and local policies aimed at maintaining racial segregation significantly harmed resident wealth, health and well-being across generations and, by extension, entire neighborhoods. Today, these communities often lack adequate access to healthcare, healthy foods, equitable transportation, other basic needs, and even experience higher temperatures as a result of public and private disinvestment, the denial of public services, and the presence of industrial and waste facilities — just some of the many consequences of a practice known as redlining.

What is redlining?

Redlining maps were used by the federal government in the early-to-mid 20th century to legally prevent Black Americans from accessing homeownership — one of the most effective ways to support economic mobility and build wealth.

As a result, Black residents who live in these formerly-redlined neighborhoods still tend to have lower homeownership rates, higher levels of poverty, lower future earnings, worse health outcomes and lower average life expectancies today. Though the practice of redlining was outlawed in 1968, its effects can still be seen and felt today through a staggering wealth gap in which Black Americans hold only 13% of the median net worth of white families.

These problems are complex and run deep. Correcting these injustices will require, among other things, intentional, philanthropic investment to support organizations that work to improve the historic, long-term disparities Black residents face. As Understanding Houston observes Black History Month, we will do so with a holistic perspective that celebrates the heritage and contributions of Black communities, scrutinizes the past and present, and looks ahead to a brighter future. Here, we examine the legacy of redlining in Houston.

A brief background of redlining in America

What was the purpose of redlining, and how did it come to be? The Home Owners’ Loan Corporation (HOLC) was created in 1933 in the midst of the Great Depression to protect homeowners from losing their homes. The agency purchased mortgages that were facing imminent foreclosure and issued new mortgages with longer repayment timelines and, for the first time, offered an amortized schedule so buyers could gain equity as they paid off the loan.

To depict the level of risk in making home loans in various communities, HOLC created a series of multi-colored residential maps for 239 cities across the nation, including major cities in Texas. HOLC assigned communities a rating from A through D to designate the level of “risk” in investment.

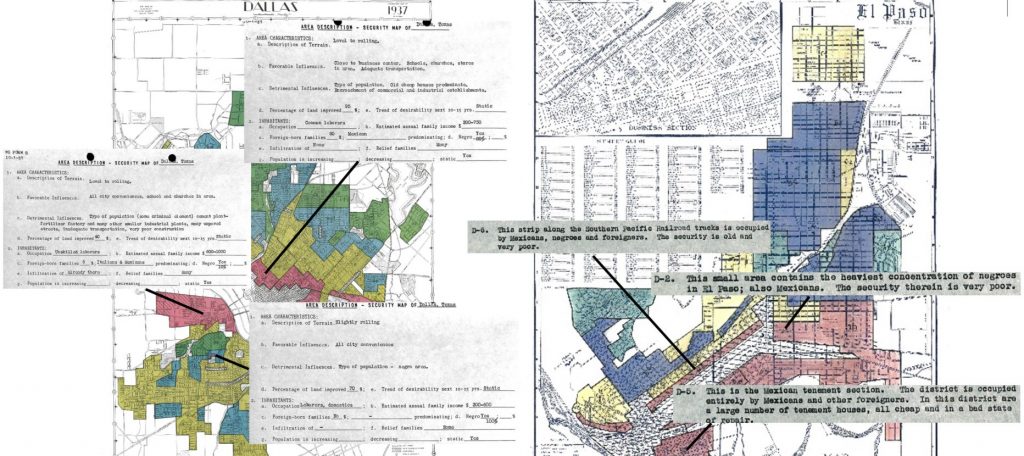

Neighborhoods that were all-white were given an “A” rating, colored green, and denoted as a “best” area for investment. Meanwhile, if a single Black family lived in an area (regardless of neighborhood income level), it was automatically assigned “D” to indicate a “hazardous” investment and colored in red — hence the term “redlining.” Neighborhoods assigned D and C (categorized as “definitely declining” in yellow) ratings were also communities where immigrants or their children lived, as detailed in the redlining maps from Dallas and El Paso below. Read the area descriptions that informed the ratings for Dallas and El Paso (warning: the area descriptions contain overtly offensive comments).1

Residential Security Maps of El Paso and Dallas.

Source: Mapping Inequality: Redlining In New Deal America

Shortly after, in 1934, the Federal Housing Administration (FHA) was established to provide federally backed insurance for mortgage loans. The FHA dramatically changed mortgage lending and made homeownership much more attainable and affordable — for a very specific segment of the population.

To guide the work of private real estate agents who conducted most property appraisals, the FHA created an Underwriting Manual in 1938, which relied on HOLC’s maps. This manual explicitly outlined the requirement of creating and maintaining “racially homogenous” neighborhoods and identified eligibility criteria which automatically denied Black applicants.

Since FHA-backed loans bear less risk to the lender, banks would not provide mortgages that the FHA would not insure — meaning, mortgages to Black applicants. As a result, between 1930 and 1950, only 2% of FHA mortgages went to non-white families.

The practice of redlining and other discriminatory housing policies legally excluded Black families from receiving fair housing mortgages for over 30 years. Major government investments aimed at making homeownership more accessible to low- and middle-income families largely benefited white families only — the effects of this injustice were then compounded from generation to generation and persist to this day.

Though redlining was deemed unconstitutional in 1968 with the passage of the Fair Housing Act, efforts to prevent Black homeownership and integration did not end there. The policies of these federal agencies provided the systemic infrastructure for the perpetuation of discriminatory housing practices. Even after 1968, the federal government did not enforce the Equal Protection Clause of the 14th Amendment and regularly supported restrictive covenants that excluded Black families from homeownership and policies that continued to segregate Black residents.

“…much of today’s racial disparities in housing, health, and education can be traced to our legacy of redlining and segregationist policies. This is a foundational issue that set a course for wealth disparity and racial injustice.”

– Luis Guajardo, Urban Policy Research Manager at Rice University’s Kinder Institute for Urban Research

How racial discrimination unfolds in the modern housing market

Compounding historical injustices, Black families still face housing discrimination (racial discrimination in the housing market) in countless forms:

- A national study found that Black applicants are denied mortgages at disproportionately higher rates than whites.

- As recently as 2016, the Consumer Financial Protection Bureau and Department of Justice have required lending institutions to pay out millions of dollars for illegal redlining and discriminatory mortgage lending practices.

- Studies have found that housing discrimination is still widespread through more covert means like racial steering, a practice in which real estate agents deliberately steer Black potential homebuyers to areas with larger concentrations of people of color, higher poverty levels and lower housing quality.

- Agents tend to show white homebuyers more homes than they do in the case of equally qualified Black homebuyers.

- Homes in neighborhoods where there is a large concentration of Black families are appraised at lower market values (an average of 23% less, or $48,000), even among households of similar size and condition.

- Lenders disproportionately market risky loans to Black families. In 2000, Black homeowners were significantly more likely to hold subprime loans than white borrowers at each income level. Higher-income Black households held subprime mortgages at four times the rate of higher-income white households.2 Not surprisingly, Black homeowners were the most harmed in the 2008 housing crisis, and between 2010 and 2017, the homeownership rate among Black households in Houston’s three-county region declined by five percentage points while white homeownership rates remained flat.

“The biggest issues have been lending institutions and appraisers and realtors not wanting to show properties [to Black individuals] in certain areas.”

– Shadrick Bogany, Past Chairman of Houston Association of Realtors and Columnist for the Houston Chronicle

The impact of discriminatory housing policies today on Black Houstonians and communities

The negative impact of discriminatory federal housing policies cannot be overstated. The practice of redlining, combined with other housing policies intent on racial exclusion, led to two major inequities we see today:

1) The systematic exclusion of Black households from homeownership, which limited their ability to build and grow wealth across generations, resulting in extreme racial wealth disparities.

2) The isolation and deterioration of predominantly Black neighborhoods which created concentrated areas of poverty characterized by greater environmental risks, poor health outcomes, reduced life expectancy and little-to-no access to essential resources such as safe and affordable housing, high-quality schools, equitable transportation, green space and fresh and affordable food options.

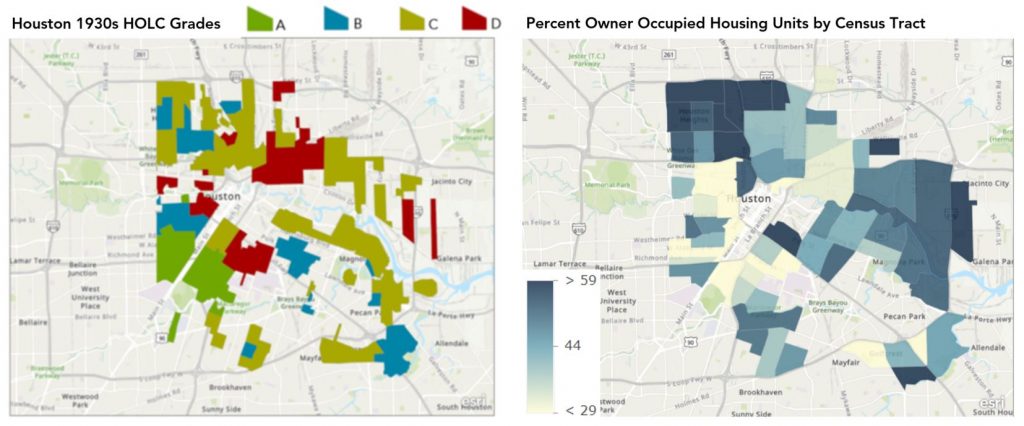

How redlining affects homeownership in Houston

It is impossible to separate present-day homeownership rates from decades of discriminatory housing policies that prevented Black families from owning homes in the past. Across the Houston three-county area, 72% of white residents are homeowners compared to 41% of Black residents and 52% of Hispanic residents.

Source: Mapping Inequality; Understanding Houston analysis of U.S. Census Bureau, American Community Survey, 2019 5-year estimates data

Communities that were rated either “D” or “C” in the 1930s tend to have lower homeownership rates compared to communities that were given “A” HOLC grades. For example, 31.2% of residents in Fifth Ward (previously redlined) are homeowners compared to 48.1% of residents in the Museum District and 65.6% of residents in the Heights (rated “A”). These disparities show the persistent obstacles that families in Houston’s redlined neighborhoods face in accessing homeownership.

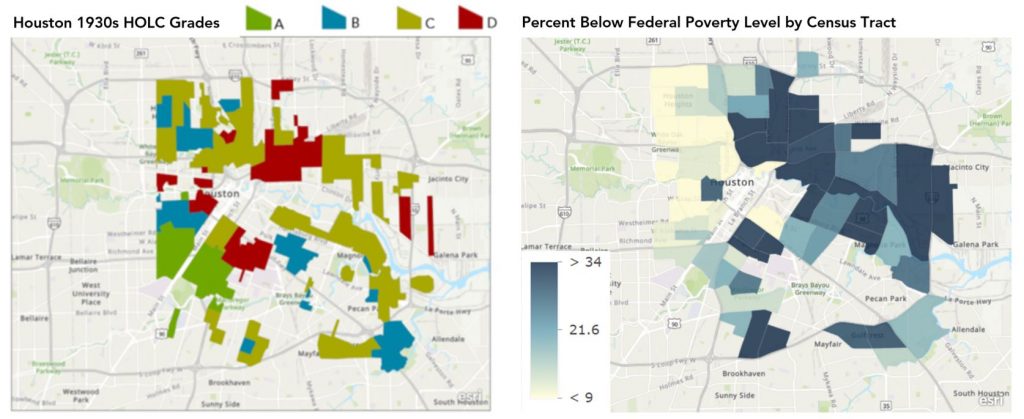

How redlining affects wealth and poverty in Houston

Homeownership is the most common pathway toward economic security, social mobility, and wealth creation and particularly critical to upward mobility for the majority of low-income and non-white households since that wealth can be passed to future generations, according to a study from the Joint Center for Housing Studies at Harvard University. In 2019, the median net worth among homeowners was $255,000, while that of renters was $6,300, according to the Federal Reserve.

However, the practice of redlining prevented Black Americans from accessing the same homeownership opportunities that were afforded to white families. This would negatively impact Black families for generations and is a significant factor in the extreme racial wealth gap that exists today. The median net worth of white families in 2019 was $188,200 compared to $24,100 among Black families — despite a 33% increase in wealth for Black families between 2016–19.

“The impact of that level of lost wealth cannot be underestimated — not only in net worth but also in the lost opportunities that wealth allows in terms of investments in education, businesses, and other revenue-generating endeavors.“

– Tanweer Kaleemullah, Public Health Policy Analyst at Harris County Public Health

Source: Mapping Inequality; Understanding Houston analysis of U.S. Census Bureau, American Community Survey, 2019 5-year estimates data

Therefore, it is not surprising that poverty rates are higher in redlined communities than in greenlined ones and higher among Black households than white ones. There is a cluster of communities around the east side of Houston (redlined) in which a higher percentage of individuals live in poverty compared to the west side (greenlined). For example, the poverty rate in Fifth Ward is 32.6% compared to 7.3% in Montrose. And across Houston’s three-county region, 20% of Black residents live in poverty compared to 7% of white residents.

How redlining affects future income and earnings in Houston

Where we grow up profoundly affects our future. Neighborhoods give us resources, networks and opportunities. Or, they don’t. The lack of wealth accumulation among families across generations, compounded with perpetual disinvestment, created concentrated areas of poverty. Notable ripple effects include low property values resulting in lost tax revenue for schools, limiting access to high quality education and little private sector investment, which stifles business growth and employment opportunities. This matters because children who are raised in neighborhoods with lower poverty rates, less measured discrimination and higher levels of educational attainment tend to have better outcomes as adults (e.g., lower incarceration rates, higher household incomes, higher educational attainment and higher levels of employment). And, places that produce good outcomes in the past tend to produce good outcomes in the future. Homeownership has been identified as an effective way to create that neighborhood stability.

Opportunity Atlas, an interactive tool from the Census Bureau and researchers from Harvard and Brown University, measures the extent to which groups move up (or down) the economic ladder by looking at various outcomes of adults and back-mapping where they grew up (read more about the methods and peer-reviewed paper here). The data reveals staggering differences in earnings for adults who grew up in low-income households that were located in wealthier neighborhoods versus lower-income neighborhoods. Being in an environment with access to the resources typically available in higher-income neighborhoods allows a child from a low-income household a greater chance to prosper in the future.

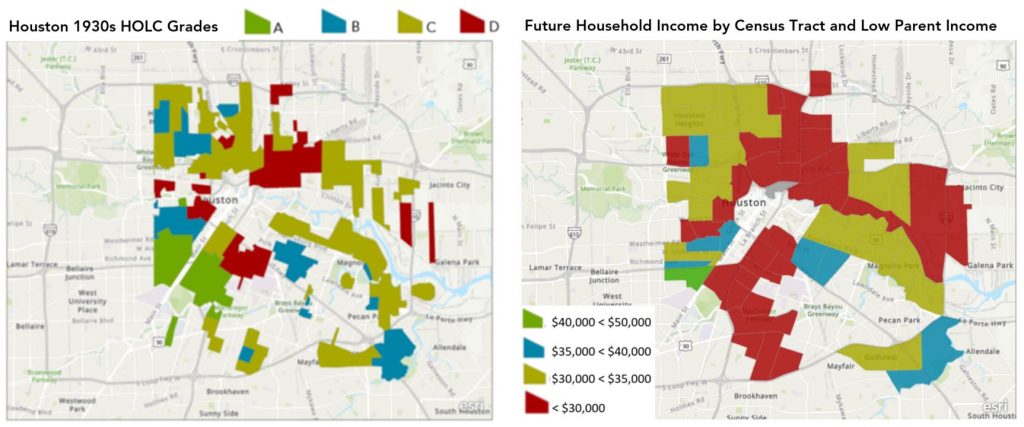

Source: Mapping Inequality; Opportunity Atlas

Neighborhoods that were previously redlined generally produce low future earnings for adults raised in low-income households. Among the neighborhoods rated by HOLC, only one community produced high future earnings for individuals who grew up in low-income households — the Museum District — which received an A rating by HOLC in the 1930s.

How redlining affects social vulnerability in Houston

Communities that were redlined 90 years ago are also more vulnerable to impacts from economic and environmental threats today, including being disproportionately impacted by COVID-19 in Houston. Job and income loss from economic recessions are higher among residents who live in previously redlined neighborhoods that are currently distressed, residents tend to have worse health outcomes as redlined communities are more likely to be exposed to environmental hazards, and most residents lack savings which acts as a safety net during difficult times.

The Centers for Disease Control and Prevention’s Social Vulnerability Index (SVI) ranks each census tract on 15 demographic and social factors, including poverty, unemployment, family structure, lack of vehicle access, non-white population, disability and housing. Used together, this index helps identify communities that are more vulnerable to being negatively affected by hazardous events such as natural disasters like hurricanes and disease outbreaks like COVID-19.

Continue reading about the Social Vulnerability Index, and risks associated with disasters and flooding in Houston

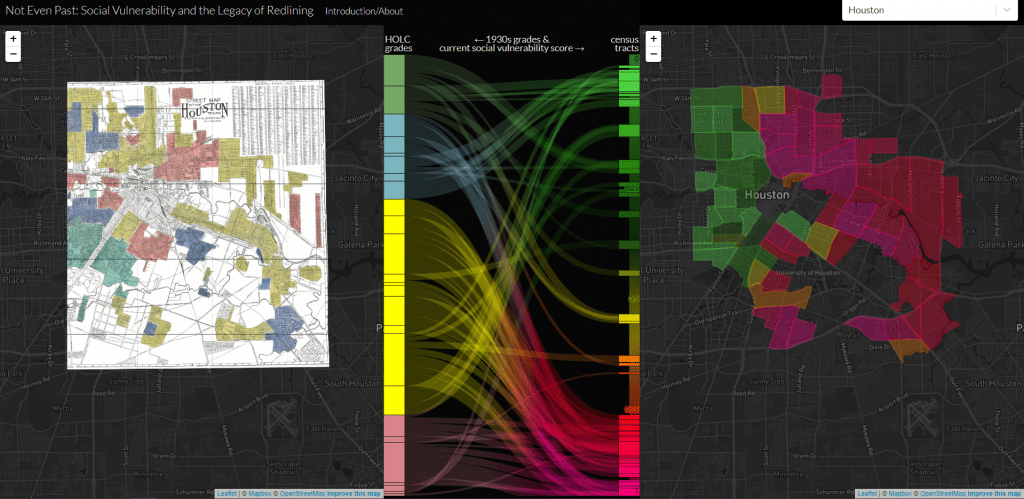

Source: Not Even Past: Social Vulnerability and the Legacy of Redlining

What were the redlined neighborhoods in Houston, and what does the Social Vulnerability Index tell us about them? Houston’s redlined neighborhoods — Sunnyside, Third Ward and Fifth Ward — are located on the east side of the city and have SVI ratings of 0.84 or higher, making them more vulnerable than upwards of 80% of communities across the U.S, according to Not Even Past: Social Vulnerability and the Legacy of Redlining, an interactive tool that compares communities from the redlining maps to their current SVI. Areas that were given a grade of “A” — the Heights, West University Place and Montrose — have SVI ratings of 0.24 or lower, making them more vulnerable than, at most, 24% of communities across the U.S. and tend to be located on the west side.

Environmental hazards, health outcomes and life expectancy

Industrial and toxic-waste facilities in Houston are disproportionately found in Black neighborhoods — or in neighborhoods with a high concentration of non-white or low-income residents — due in part to redlining. This has consequences because the environment is a major determinant of health. A recent report from the Texas Department of State Health Services found that children in Fifth Ward and Kashmere Gardens were diagnosed with leukemia at nearly five times the expected rate of the Houston population, and cancer rates for children who live in the 100 homes located above a “toxic plume” were even worse. This isn’t the first cancer cluster in the region.

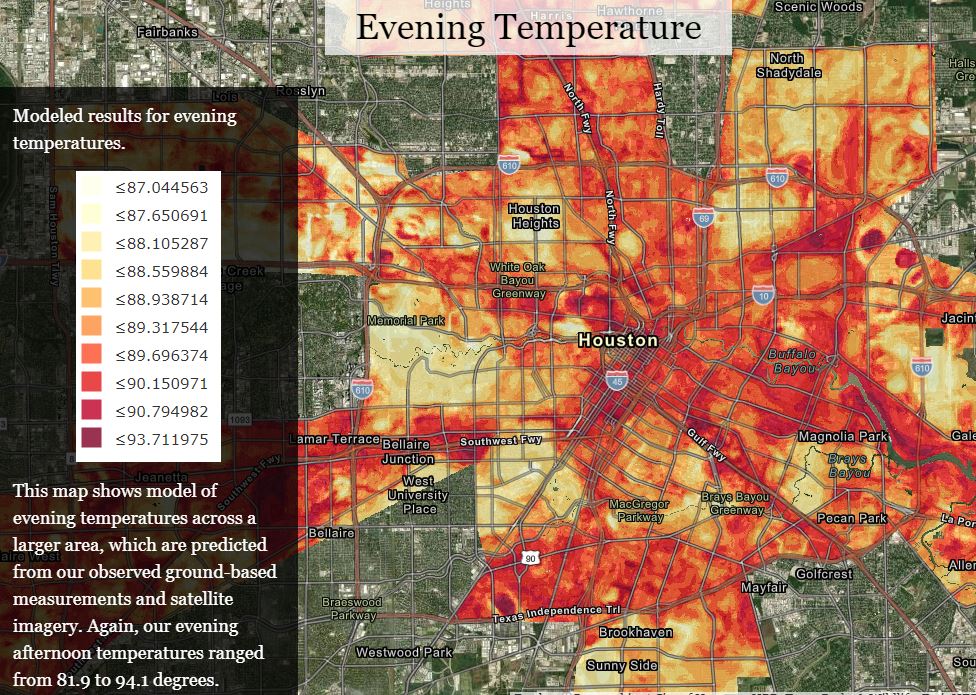

Additionally, formerly redlined communities overwhelmingly experience hotter temperatures than communities that were given better HOLC grades. Some neighborhoods in the same city differed by nearly 13 degrees.

We see this phenomenon in Houston. Neighborhoods that have the highest nighttime temperatures in Houston — the greatest driver of heat-related health issues — are concentrated in areas that were redlined, according to maps created by Houston Harris Heat Action Team.

These dramatic differences in temperature have dire health consequences. FEMA warns that extreme heat kills more Americans than other weather-related disasters, and the World Health Organization states that temperature extremes can exacerbate chronic cardiovascular, respiratory and diabetes-related conditions. This is especially problematic since there is a higher prevalence of diseases and poor health conditions such as diabetes, kidney disease, pulmonary disease and obesity in neighborhoods that were previously redlined — due, in part, to the unsafe environment in these communities.

Environmental conditions account for nearly 25% of all deaths and likely comprise 70-90% of the total risk in the development of chronic diseases, according to research from Harris County Public Health, which means the neighborhood we live in ultimately shapes how long we will live.

Redlined communities on the east side of Houston overwhelmingly have lower average life expectancies than those on the west side. For example, the average life expectancy in previously-redlined Fifth Ward is 70 years compared to 80 years in Montrose, according to analysis from the Episcopal Health Foundation.

“…primary challenges as a result of redlining [include] an increased health risk as a result of toxic exposures and poverty-related stress that causes a large gap in life expectancy, [and] the inability to recover from climate crises on a neighborhood and household level”

– Zoe Middleton, Houston and Southeast Texas Co-Director at Texas Housers

What we can do to support historically marginalized communities

The past never stays in the past. Without the acknowledgment and repair of historical injustices, the past will continue to haunt our present. The challenges many Black residents face in building homeownership, wealth and good health is inextricably linked to the discriminatory housing policies created and enforced by our federal government 90 years ago. And while we also see incredible resilience, perseverance and power in communities that have been historically marginalized in Houston, our region’s collective progress depends on our ability to better understand the root causes that have contributed to the disparities we see today.

“Individuals should…advocate for earnest reckoning with previous wrongs…showing a willingness to sacrifice a modicum of the privilege and comfort they may have in order to see resources go to other communities than their own.”

– Kyle Shelton, Deputy Director at Rice University’s Kinder Institute for Urban Research

Here are some things we can do:

- Engage with residents and community leaders: Meet with individuals and organizations in these communities and seek to understand their needs and challenges. Offer to volunteer with organizations and work with them to identify ways that you can support ongoing work.

- Support CDFIs in your community: Community Development Financial Institutions (CDFIs) promote economic revitalization with financial assistance to under-resourced neighborhoods and populations.

- Donate in these neighborhoods: Find Black-led Organizations through GHCF’s Giving Guide or, if you are a Greater Houston Community Foundation donor, talk to your relationship manager about how you can be most impactful with your grants in these areas.

- Support Houston’s Complete Communities Initiative: The City of Houston’s Complete Communities Initiative works in partnership with Houston’s historically most under-resourced neighborhoods so that all of Houston’s residents and business owners can have access to quality services and amenities. Watch our interview with Shannon Buggs, Director of Complete Communities, highlighting the need in our region and the opportunities they are providing.

- Reach out: As Greater Houston Community Foundation explores what more it can do as a partner to address economic disparities in Houston, we are listening and learning from readers like you. Sign-up to receive our monthly newsletter and contact us to get involved.

“I am hopeful with cautious optimism for seeing more evidence-based justice, promoting the general welfare, liberty, and posterity for all. I hope we see our lofty ideals in practice for the common good.”

– Theophilus Herrington, Rutherford B. H. Yates Museum

Resources for Further Learning

- Read Key Insights from our webinar on housing disparities.

- Listen to In The Thick: The Legacy of Redlining where they discuss discrimination, housing segregation, and how redlining still shapes our cities today with Richard Rothstein, author of the book The Color of Law, and Emmanuel Martinez, data reporter for Reveal.

- Watch Richard Rothstein on Book TV hosted by C-SPAN talk in detail about his book The Color of Law: A Forgotten History of How Our Government Segregated America.

Helpful Articles by Understanding Houston:

- Examining the Effects of Environmental Inequity in Houston

- Key Insights: Ending Homelessness in Houston Event

- A Closer Look at Financial Hardship in Houston

- The 21-Year Gap in Life Expectancy

- Three Facts Every Houstonian Should Know About Natural Disasters in Houston

1 “Still Desirable” neighborhoods were graded “B” and colored blue. “Definitely Declining” neighborhoods were graded “C” and colored yellow.

2 Rothstein, R. (2017). The Color of Law: A Forgotten History of How Our Government Segregated America (Reprint ed.). Liveright.