Housing in Houston has become less affordable, and low-income households bear the greatest burden

In partnership with Rice University’s Kinder Institute for Urban Research, Greater Houston Community Foundation hosted a Housing Inequities program on October 20 to educate and engage donors and community partners on inequities in housing affordability, supply, and vulnerability in Greater Houston.

The webinar featured Maria Aguirre-Borrero, Avenue; Jonathan Brooks, LINK Houston; Paul Charles, Neighborhood Recovery CDC; Anne Gatling Hayne, Houston Land Bank; Zoe Middleton, Texas Housers; and Kyle Shelton, Kinder Institute.

During this informative session, we explored a variety of crucial data and valuable perspectives; these are the three core insights driving the conversation on Housing in Greater Houston.

We invite you to watch the full presentation here.

Houston housing is not as affordable as we’ve been told

Houston’s “legendary” reputation for affordability has fueled the region’s record-setting population growth over the past few decades. However, Greater Houston has become more expensive in recent years, primarily because of housing costs. Home prices and rent have grown much faster than wages and income, and there is a lack of affordable and healthy housing for low- and moderate-income families.

Home values in each of Greater Houston’s three most populous counties have increased at a faster rate than in the nation overall. Between 2010 and 2017, median home values rose 33% in Fort Bend County, 31% in Montgomery County and 17% in Harris County, compared to 7% nationally.

Rent is rising for renters, too. Median rents climbed faster in both Fort Bend and Montgomery counties than in Harris County, Texas, and the nation in that same time period.

Renters and homeowners in Greater Houston have been facing increased housing costs for the last several years.

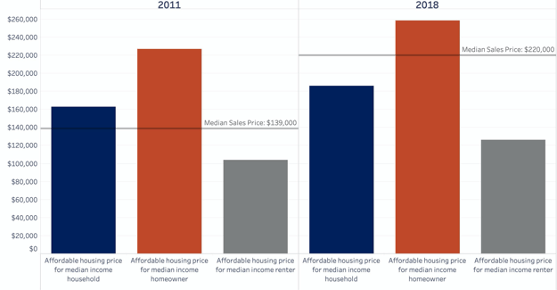

The housing affordability gap measures the difference between the price of an affordable home for a median-income household (i.e., no more than 30% of income) and the median sales price for a home in the area. The affordability gap in Harris County widened between 2011 and 2018, according to the 2020 State of Housing in Harris County and Houston from the Kinder Institute.

In 2018, a household with median income of $60,146 could afford a $186,300 home in Harris County. But the median home price was $220,000. This $33,700 gap is the difference between what households at the middle income level can afford and what is available. Among renters, the affordability gap stretches to $93,500.

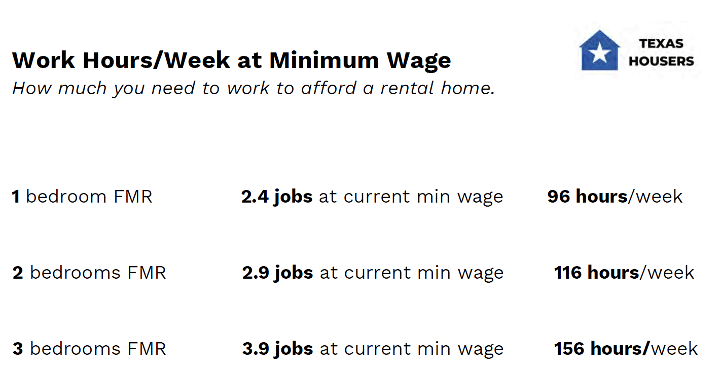

Zoe Middleton from Texas Housers illustrated how low-income households are constrained by both rising rents and stagnant wages. Citing data from the National Low Income Housing Coalition, Zoe explained that a person earning minimum wage would need to work 96 hours per week to afford a fair market rate (FMR) one-bedroom apartment in Harris County, 116 hours per week to afford a two-bedroom, and 156 hours per week for a three-bedroom.

As home prices push more families out of the market, the number of renters in the region has grown. This trend has significant implications because renters are more likely to be cost burdened than homeowners due to their lower median incomes compared to homeowners. In the three-county Houston area, 46% of renters spend at least 30% of their income on housing compared to 21% of homeowners. Renters are three times as likely to spend at least half their income on housing as homeowners.

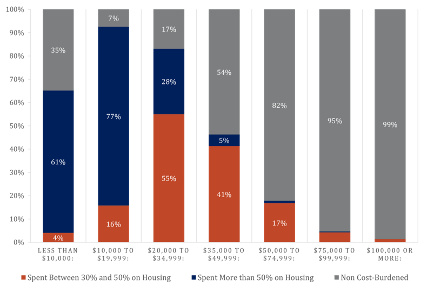

Cost-Burdened Renter Households by Income Level, Harris County, 2018

The burden weighs heavier for those with low incomes. Households with incomes less than $50,000 in Harris County are significantly cost burdened. This disparity is most striking for households that earn less than $30,000. The overwhelming majority (93%) of households that earn between $10,000 and $20,000 in Harris County spend at least 30% of their income on housing compared to 18% of households with incomes between $50,000 and $75,000.

“In the three-county Houston area, renters are three times more likely than homeowners to spend at least half their income on housing.”

Lack of affordable and safe housing in Houston is costly

Houston, like many other large metros, does not have sufficient supply of affordable, safe and healthy housing — particularly for households with low incomes — but even for median-income earners. “The stock is skewed towards single family or very large multifamily,” Kyle Shelton from the Kinder Institute explains. “Houston struggles to provide the missing middle — smaller multifamily units that are typically more affordable.”

New housing construction trends indicate a growing supply of future multi-family units, but those tend to be higher-priced. Meanwhile, existing affordable units are in decline.

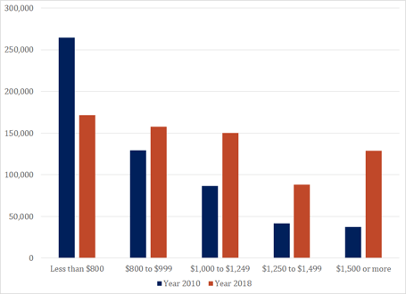

Renter-occupied Housing Units by Gross Rent, Harris County, 2010 and 2018

In 2010 in Harris County, there was more availability among units with lower rent. However, in 2018, the supply of units with lower rent fell while units with rent above $1,500 per month surged.

“Houston struggles to provide the missing middle — smaller multifamily units that are typically more affordable.”

Greater Houston’s housing crisis “has been going on for a while, but has hit an inflection point,” Anne Gatling Hayne from the Texas Land Bank states.

We already see the consequences.

About 3,600 individuals experienced homelessness in 2019, according to the Coalition for the Homeless. While that number is half of what it was in 2011, progress has plateaued recently.

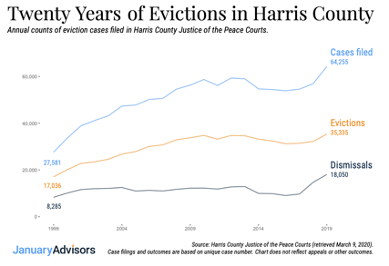

Harris County has led the nation in evictions over the past two decades, and the number of evictions in the region remains higher compared to other metros since COVID-19’s onset — another consequence of the region’s housing crisis. “[Evictions] destabilize households and the overall housing system in the region,” Shelton warns.

Homeownership is still the most significant way to build wealth — the kind that can be transferred to future generations and compounded. Barriers to homeownership not only rob families of current and future wealth, but also they weaken communities through decades of disinvestment.

The fact that the majority of predominantly Black and Brown neighborhoods in the region are located in areas characterized by older, lower-quality housing is the legacy of racial segregation in Houston. Twentieth century legal federal housing policies and banks denied mortgage and maintenance loans for homes located in predominantly Black and Brown neighborhoods. This trend of devaluing Black property continues today, Paul Charles from Neighborhood Recovery CDC clarified, which accelerates disrepair, sharing a powerful story and concluding: “So does redlining still exist?… Yes. Redlining still occurs. Redlining shows up in mortgage loans, appraisals, and insurance…which leads to devaluation of personal and community wealth.”

For these reasons and more, combined with slower recovery after the Great Recession and recent natural disasters, Black homeownership rates are the lowest in the region, and fell to 41% in 2017 from 46% in 2010. For comparison, the homeownership rate for White households is 71%.

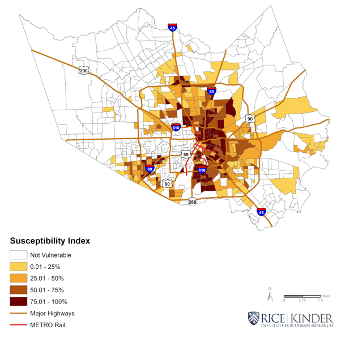

The intersection of rising home prices/rents and stagnant incomes for low-income households makes neighborhoods more vulnerable to gentrification. This can lead to the displacement of long-term residents and even threaten homeownership. Black communities in Harris County are among the most susceptible to gentrification, according to the State of Housing report.

Environmental and climate change is crucial to consider as insufficient healthy and safe housing negatively impacts resident health. Majority-Black neighborhoods report worse air and water quality, higher temperatures, and increased susceptibility to flooding.

Higher housing costs increase transportation costs

Jonathan Brooks from LINK Houston emphasizes that transportation is the ultimate “shared interest” of housing. It literally connects us to opportunities, people, and places, which is why transportation equity and affordability is crucial to housing. A community’s transportation infrastructure, or built environment, should include high quality, safe, accessible sidewalks, bikeways, streets, transit stops, and drainage.

Because housing is taking up a larger share of incomes, many “choose” to live farther from the traditional center of the region’s economic hub, the city of Houston proper in Harris County. Given Houston’s geographic reach, this results in substantial transportation costs.

Fort Bend residents spend 60% of their income on housing and transportation alone. That’s a larger chunk than what families in Los Angeles County — notorious for its expensive housing market and lengthy commutes — spend.

How we can work together to solve Houston’s housing issues

It’s easy to get lost in the numbers. Maria Aguirre-Borrero from Avenue grounded the conversation in why housing matters. She shared a story about a 31-year old man whose greatest hope is to live in the same community in which he was raised. But, that dream seems intangible given his low income and college expenses. Reluctantly, he and his family are thinking of moving somewhere else more affordable or living together in overcrowded living conditions–another housing issue where the three-county region trends more poorly than Texas and the nation.

Housing is inherently about community. When diverse and rich communities are displaced, or when people have less money for essentials like education, food, healthcare or savings because housing and transportation costs cannibalize incomes, we will continue to see more housing vulnerability. The good news is, many smart and dedicated people and organizations are working to reverse negative trends.

Here are some of the steps we can all take to help improve access to housing in Greater Houston:

- Fund what others can’t or don’t. That includes advocacy for sound and equitable housing policies at the local, city, and county level; grassroots organizations; and innovative pilot programs and projects. Philanthropy can take risks — the results of which potentially allow the government to step in to scale. These dollars fund systems change.

- Use your voice to advocate for and fund equitable housing initiatives and policies that prioritize low-income and historically marginalized by talking with your neighbors about this issue and contacting local officials to voice your concerns.

- Consider what you’re already funding. Think about housing and transportation issues related to areas or populations you already fund. Be open to funding transportation and housing line items and asking questions about the transportation options being provided to residents in the process. Invest in organizations working on this issue to build their capacity, provide general operating support, or flexible capital that can complement or enhance other funds. Here are just a few organizations we’ve worked with to know about:

- BakerRipley

- Coalition for the Homeless of Houston/Harris County

- Covenant House Texas

- Fifth Ward Community Redevelopment Corporation

- HomeAid Houston

- Homeless Youth Network of Houston Harris County

- Houston Area Women’s Center

- Houston Habitat for Humanity

- Houston Local Initiatives Support Collaboration

- LINK Houston

- Neighborhood Recovery Community Development Corporation

- New Hope Housing

- Open Door Mission

- Project Row Houses

- Rebuilding Together Houston

- SEARCH Homeless Services

- Star of Hope Mission

- Texas Housers

Continue to learn and explore housing in Houston and how it intersects with other issues like transportation. Our panelists recommend the following (not exhaustive or in any particular order):

- Report: Where Affordable Housing and Transportation Meet in Houston

- Research: Hazardous: The Redlining of Houston Neighborhoods

- Case: Durham Affordable Housing Loan Fund

- Case: Detroit Housing for the Future Fund

- Fund: NOAH Impact Fund

- Webinar: Evictions in Houston and Harris County

- Dashboard: Harris County Evictions

- Map: The Eviction Lab